He also expressed his resolve to break the vicious cycle of overreliance on borrowing for public spending, and the resultant burden of debt servicing.

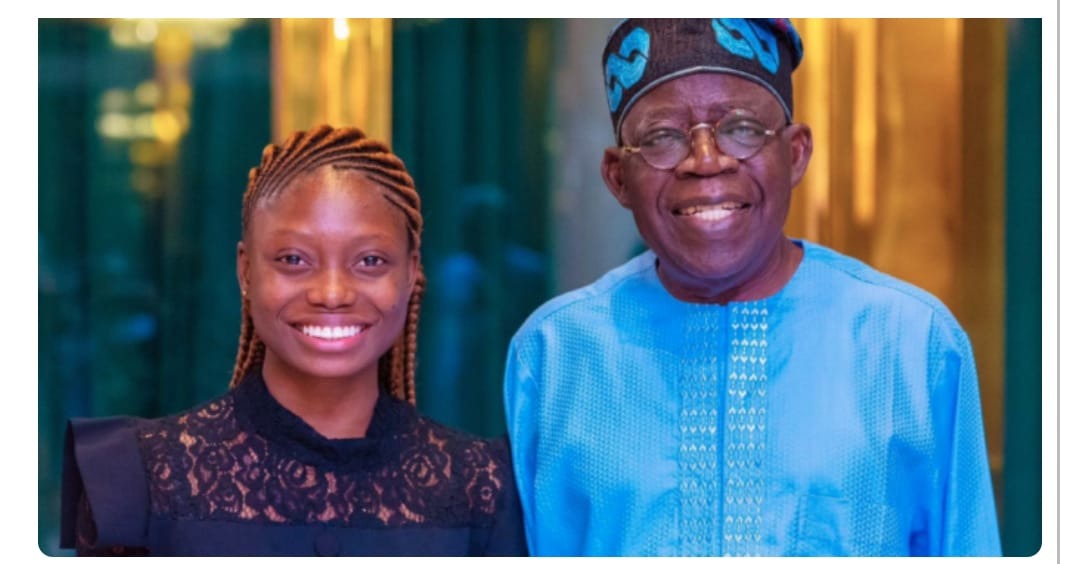

The President spoke, while inaugurating the Presidential Committee on Fiscal Policy and Tax Reforms, chaired by Taiwo Oyedele, in Abuja on Tuesday.

A 400-level Economics student of the University of Ibadan, Orire Agbaje, was appointed by the President as a member of the presidential committee on fiscal policy and tax reforms.

Tinubu said, “Our aim is to transform the tax system to support sustainable development while achieving a minimum of 18 per cent tax-to-GDP ratio within the next three years.

“Without revenue, government cannot provide adequate social services to the people it is entrusted to serve.

“The committee, in the first instance, is expected to deliver a schedule of quick reforms that can be implemented within 30 days. Critical reform measures should be recommended within six months, and full implementation will take place within one calendar year.”

Tinubu urged the committee to improve the country’s revenue profile and business environment, as the Federal Government moved to achieve 18 per cent tax-to-GDP ratio within three years.

He directed the committee to achieve its one-year mandate, which was divided into three main areas: fiscal governance, tax reforms, and growth facilitation.

He also directed all government ministries and departments to cooperate fully with the committee, stressing that there would be no excuse for failure.

Tinubu said, “We cannot blame the people for expecting much from us. To whom much is given, much is expected.

“It is even more so when we campaigned on a promise of a better country anchored on our Renewed Hope Agenda. I have committed myself to use every minute I spend in this office to work to improve the quality of life of our people.”

The President said Nigeria was still faced with challenges in areas such as ease of tax payment and its tax-to-GDP ratio.

The Chairman of the Committee, Oyedele, pledged that the members would give their best in the interest of the nation.

“Many of our existing laws are out-dated, hence, they require comprehensive updates to achieve full harmonisation to address the multiplicity of taxes, and to remove the burden on the poor and vulnerable while addressing the concerns of all investors, big and small,” he said.

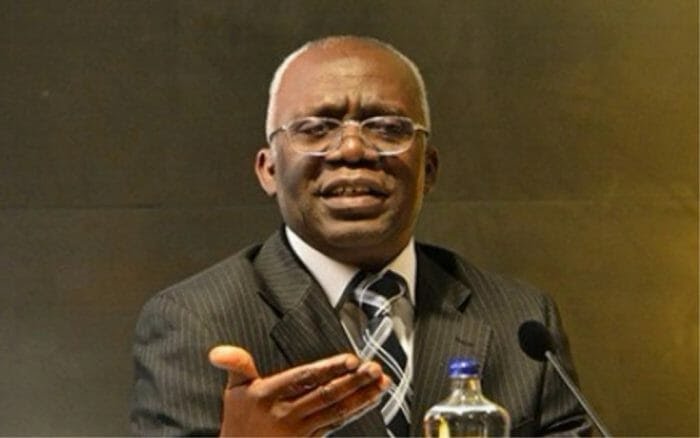

The Special Adviser to the President on Revenue, Zacchaeus Adedeji, described the committee members, drawn from the public and private sectors, as accomplished individuals from various sectors.

He said, “Mr President, you have the pedigree when it comes to revenue transformation. You demonstrated this when you were the Governor of Lagos State over 20 years ago.”