The Central Bank of Nigeria (CBN) has the Nigerian economy has maintained a positive growth trajectory for nine consecutive quarters, since exiting recession in 2020.

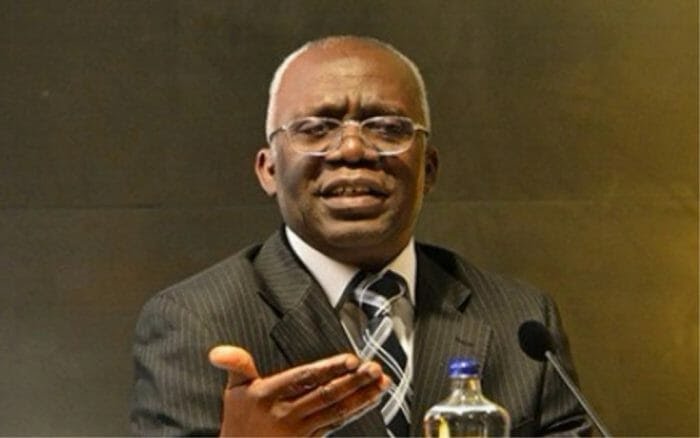

The CBN Governor, Mr Godwin Emefiele, said this on Tuesday in Abuja, when he read the communique issued at the end of the 290th meeting of the Monetary Policy Committee (MPC) meeting of the apex bank.

According to Emefiele, the improved performance of the economy has been driven largely by sustained growth in the services and agricultural sectors.

He also cited a rebound in economic activities associated with economic recovery and continued intervention in growth enhancing sectors by the CBN as responsible for the growth.

“Staff projections showed that output growth recovery is expected to continue into 2023 and 2024.

“The Committee, however, observed with concern, the marginal increase in headline inflation in February 2023, to 21.91 per cent, from 21.82 per cent in January 2023, a 0.09 percentage point increase.

“This increase was attributed largely to a minimal rise in the food component to 24.35 per cent in February 2023, from 24.32 per cent in January 2023.

Anger as Emefiele reacts to negative story about him but keeps mum on Supreme Court judgement.

“The core component moderated to 18.84 per cent in February 2023 from 19.16 per cent in January 2023,” he said.

Emefiele said that the shocks to the food component of inflation were driven by high cost of transportation of food items.

He said that lingering security challenges in major food-producing areas and legacy infrastructural problems, which continue to hamper food supply logistics were also responsible.

“Broad money supply (M3) grew by 13.14 per cent in February 2023, below the 2023 provisional annual benchmark of 17.18 per cent.

“This was driven largely by the growth in Net Foreign Assets (NFA), which was attributed to the increase in foreign asset holdings of the CBN and decrease in foreign claims on Other Depository Corporations (ODCs).

“Money market rates reflected the tight liquidity conditions in the banking system.

“Consequently, the monthly weighted average Open Buyback (OBB) and Inter-bank Call rates increased to 12.74 and 12.54 per cents in February 2023, from 10.14 and 10.35 per cent in January 2023,” he said. CONTINUE READING………………………………………………..

THIS IS FOR YOU🤳🏾👨🏼💻

For your Surprise birthday wishes, Business Advert Placement, Publicity Online and offline, Press Release, Social Media Management, For Your Content Writer Plug, Personality Promotion, Special Report, Featured Story, Conference, And Interviews – CONTACT US @VAM on WhatsApp/Call📞@ 08072633727 📲