Voice Air Media, News Update

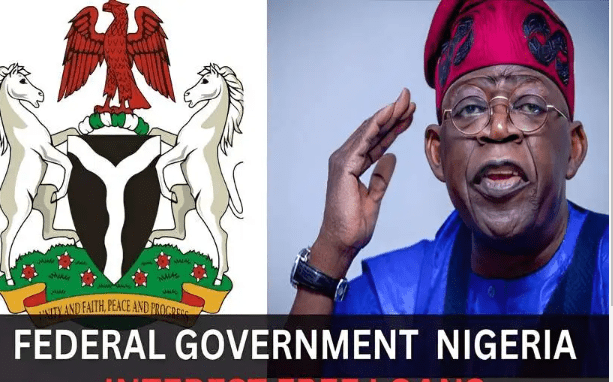

In a proactive move to address the alarming depreciation of the Naira against the Dollar, the Central Bank of Nigeria (CBN) has issued a statement, with the backing of President Bola Tinubu, announcing a comprehensive ban on the use of foreign currency in transactions within the country.

This directive, aimed at stabilizing the Nigerian economy, comes amidst growing concerns over the persistent free fall of the Naira against the Dollar and its adverse impact on the nation’s financial landscape.

The Nigerian leader threw his weight behind the CBN’s decision, emphasizing the need for stringent measures to protect the nation’s currency and foster economic stability. In a joint effort with the CBN, Tinubu highlighted the importance of curbing the use of foreign currencies in daily transactions, signaling a united front in addressing the challenges posed by the fluctuating exchange rates.

The Central Bank’s statement underscored the imperative to promote the use of the Naira as the primary medium of exchange, citing the adverse effects of relying heavily on foreign currencies for transactions. The comprehensive ban encompasses various sectors, urging businesses, financial institutions, and individuals to strictly adhere to the Naira as the sole legal tender for all transactions within the country.

Furthermore, the CBN emphasized that violators of this directive would face severe consequences, including monetary penalties and legal repercussions. The regulatory body outlined a robust enforcement mechanism to ensure strict compliance with the ban on foreign currency transactions.

The move has sparked debates among economists, policymakers, and citizens, with some applauding the proactive stance taken by the CBN and Tinubu to safeguard the stability of the Naira.

However, others express concerns about the potential challenges and adjustments that businesses and individuals may face in adapting to this significant policy shift.