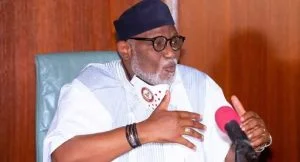

Rotimi Akeredolu, governor of Ondo state, says the move by the Federal Inland Revenue Service (FIRS) to amend the constitution by including value-added tax (VAT) in the exclusive list will fail.

Speaking in an interview with Arise TV on Sunday, he said it was unconstitutional for the federal government to be sharing VAT.

TheCable had exclusively reported moves by the revenue agency to demand the inclusion of VAT collection in the exclusive legislative list.

The FIRS and some state governments are currently embroiled in a legal tussle over VAT collection. Rivers and Lagos state governments had enacted laws and called for decentralisation of collection, while some states want a centralised collection.

While the Lagos state government is seeking to join Rivers in the suit, the matter is currently pending at the Supreme court.

Last week, the court of appeal directed states to maintain status quo on VAT collection pending the determination of an appeal filed by the FIRS.

Akeredolu, who also doubles as chairman of the southern governors’ forum, argued that VAT is under the purview of states.

According to him, the law does not give power to the FG to collect VAT and share it with the states.

“The issue of VAT, looking at the constitution, is under the purview of the states. Southern governors have taken a decision to pursue fiscal federalism. I am a lawyer. This is not a tax that is under the purview of the federal government,” Akeredolu said.

“The attempt by the FIRS and others who are clamouring for amendment is a confirmation that it does not give them the power. So, they are seeking an amendment to the constitution.

“If by the grace of God, all of us, including the south and a few states in the north, can all agree, that amendment will be dead on arrival. There is nowhere in the southern house of assemblies that it will be approved. Why seek an amendment to the constitution when the provisions are so clear?”

Akeredolu insisted that if the federal government want to collect VAT for states, it could only get a percentage of it.

“You can only collect VAT on behalf of the states and hand their money over to them. You can only take percentage there for helping us to collect the money,” he said.

In Nigeria, the revenue arising from VAT is shared among the three tiers of government based on the provisions of the VAT act such that 35% goes to the LGAs, 50% goes to state governments, while 15% goes to the federal government.

On the anti-open grazing law, he said the southern governors would not rescind their resolve on the matter.

He explained that the law was not targeted at anyone but meant to ensure the safety of lives and property.